Risk Management in Oil Trading

In the volatile world of oil trading, effective risk management is crucial for success and sustainability. This article explores key strategies to mitigate risks associated with oil trading, focusing on hedging techniques and portfolio diversification.

Understanding Oil Trading Risks

Before diving into risk management strategies, it's essential to identify the primary risks in oil trading:

- Price volatility

- Geopolitical events

- Supply and demand fluctuations

- Regulatory changes

- Counterparty risks

Hedging Techniques

Hedging is a fundamental risk management strategy in oil trading. Here are some effective hedging techniques:

1. Futures Contracts

Futures contracts allow traders to lock in prices for future oil deliveries, protecting against price fluctuations.

2. Options Trading

Options provide the right, but not the obligation, to buy or sell oil at a predetermined price, offering flexibility in risk management.

3. Swaps

Swaps enable traders to exchange cash flows based on the price of oil, helping to manage long-term price risks.

Portfolio Diversification

Diversification is another crucial strategy for managing risk in oil trading. Consider the following approaches:

1. Geographic Diversification

Spread investments across different oil-producing regions to mitigate geopolitical and regional risks.

2. Product Diversification

Trade various oil products (e.g., crude oil, gasoline, heating oil) to balance risk exposure.

3. Time Diversification

Implement a mix of short-term and long-term trading strategies to manage market volatility.

Advanced Risk Management Strategies

To further enhance your risk management approach, consider these advanced techniques:

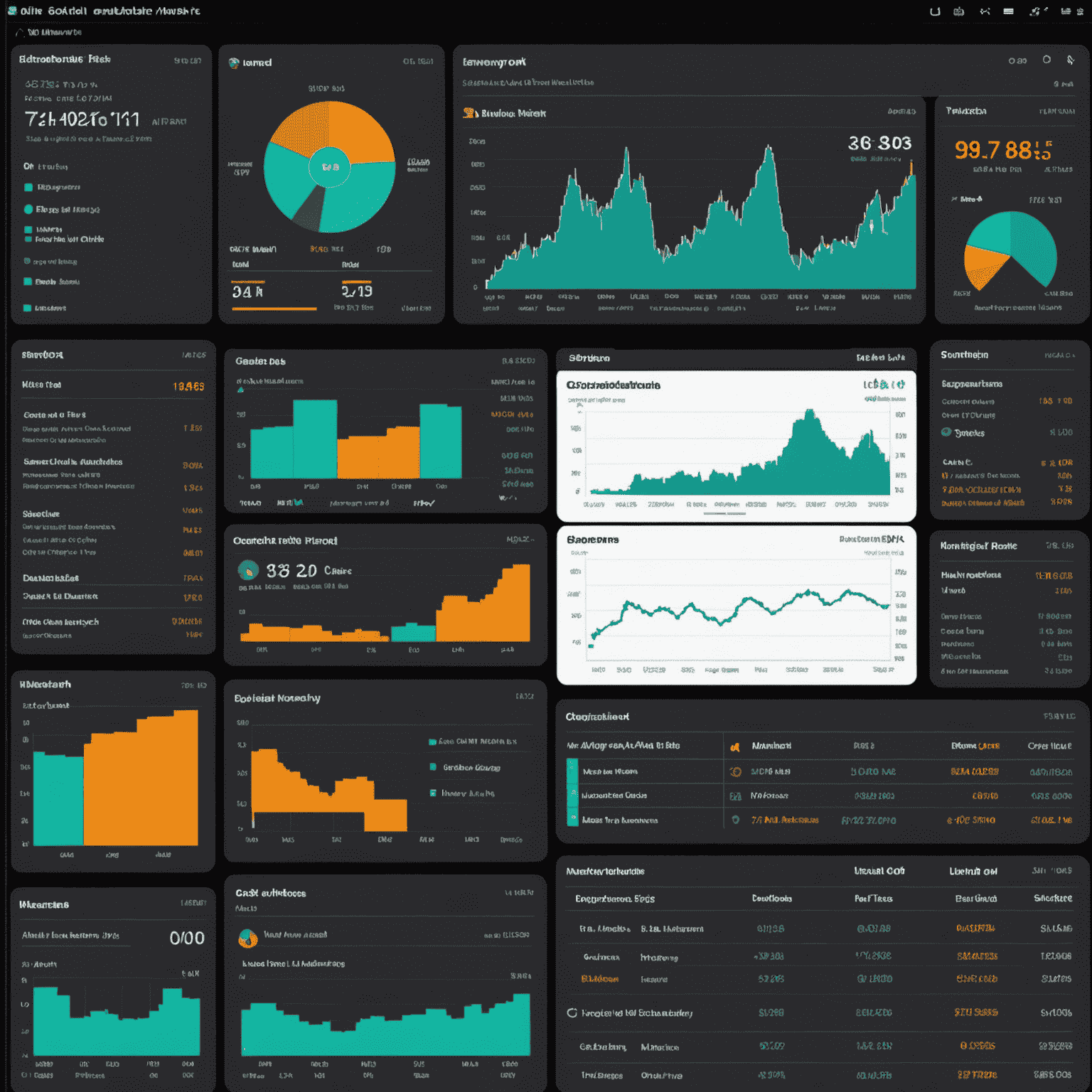

- Implement robust analytics and market intelligence systems

- Develop and adhere to strict risk limits and stop-loss orders

- Regularly stress-test your portfolio against various market scenarios

- Maintain strong relationships with multiple counterparties to reduce counterparty risk

- Stay informed about regulatory changes and adapt strategies accordingly

Conclusion

Effective risk management is the cornerstone of successful oil trading. By employing a combination of hedging techniques, portfolio diversification, and advanced risk management strategies, traders can navigate the complexities of the oil market with greater confidence and resilience. Remember, the key to long-term success in oil trading lies in continuous learning, adaptation, and disciplined risk management practices.